Chronicle

2024

Reduction in sales of industrial lighting equipment by 4% to 35 million units

Sales of commercial and industrial lighting equipment in Russia decreased by 4% in 2025 and amounted to 35 million units. This is evidenced by data from the analytical company BusinesStat, published in December 2025.

Sales dynamics over previous years have been patchy. In 2021, the volume was 49 million units. In 2022, there was a decrease of 19% to 40 million units. In 2023, recovery began with an increase of 5% to 42 million units. In 2024, a reduction of 12% to 37 million units was recorded.

The largest manufacturers of commercial and industrial lighting equipment in Russia are:

- MGK Light Technologies LLC;

- Zavod Lampiris LLC;

- Ardatov Lighting Plant JSC;

- Prom-Svet LLC;

- Volzhsky Lighting Engineering Plant Luch LLC.

The commercial and industrial light equipment market is heavily dependent on the construction sector. The demand for lighting equipment is primarily formed in the segment of new construction and overhaul. Any fluctuations in the construction industry directly affect the sales of lighting fixtures for commercial and industrial facilities.

The decline in the construction of new office buildings, shopping centers and industrial enterprises leads to a decrease in demand for the corresponding types of lighting. Construction activity determines the volume of purchases of light equipment. Delayed projects reduce orders for lighting systems.

In 2025, Russia recorded a significant amount of commissioned warehouse space, shopping complexes and office buildings. There is a tendency to reduce investment in warehouse construction. The retail and hospitality sectors have seen an increase in investment.[1]

Lamp production in Russia for the year decreased by 30% to 81.2 million units

The production of lamps in Russia in 2024 amounted to 81.2 million units, a decrease of 29.9% compared to 2023. This is evidenced by the data of the analytical company Alto Consulting Group, released in October 2025.

Despite the drop in output, the market continues to show high importance for industry and the residential segment, as electric lighting remains the basic element of infrastructure. The Central Federal District became a key manufacturing region, providing 69.4% of the total.

During theThe production category included incandescent lamps, gas discharge, arc and LED lamps. Traditional incandescent lamps are gradually being supplanted by modern technology. Gas discharge lamps are used in industrial and street lighting. LED light sources hold a growing market share.

Five reasons for the fall in production

- High competition between LED technologies and traditional incandescent lamps.

- The growing popularity of energy efficient solutions, stimulating the transition to LED lighting.

- Government programs to improve energy efficiency and reduce electricity consumption.

- Fluctuations in the market for raw materials and components, affecting the cost of production.

- Expansion of smart lighting segment and integration of lighting fixtures into building automation systems.

The concentration of output in the Central Federal District is due to the developed industrial base. The presence of powerful enterprises in the electrical industry supports production. Proximity to major consumer markets reduces logistics costs.

Large plants have equipment for the production of various types of lamps. Qualified personnel ensure process stability. The infrastructure for dealing with fragile glass products has been decades in the making.[2]

Imports of chandeliers and lamps to Russia for the year decreased by 13% to 105 million units

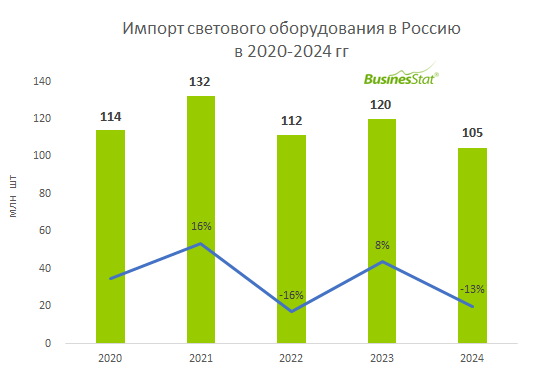

Imports of light equipment to Russia in 2024 decreased by 13% compared to 2023 and amounted to 105 million units against 120 million units in the previous period, which was the second significant decline in the last five years. The reduction in the supply of chandeliers and lamps is associated with the completion of the preferential mortgage program on July 1, 2024, which led to a decrease in effective demand for new housing and a corresponding drop in sales of lighting products. The Russian market remains highly dependent on imported light equipment, especially from China. This is evidenced by data from an analytical study for 2025, published in August 2025.

According to BusinesStat analysts, for the period from 2020 to 2024, the import of light equipment into the country decreased by 8% - from 114 million to 105 million units. Supply dynamics showed significant fluctuations, reflecting changes in the economic situation and consumer demand.

The peak volume of imports was recorded in 2021, when 132 million pieces of light devices were delivered to Russia, which is 16% higher than in 2020. The growth was driven by a recovery in economic activity after the pandemic period.

In 2022, the first significant reduction in imports to 112 million units occurred, which is 16% less than the maximum value of 2021. The decline was caused by stagnating incomes of the population and an increase in interest rates on loans.

2023 was characterized by a partial recovery of the market - imports increased by 8% to 120 million units. However, the trend reversed downward again in 2024, reaching its lowest level in the period under review.

The leading enterprises of the Russian lighting industry are:

- IEC Holding LLC.

- MGK Light Technologies LLC.

- LLC "Plant Lampiris."

- Ardatov Lighting Plant JSC.

- LLC "Prom-Svet."

The dynamics of light equipment imports is closely related to changes in the volume of lighting sales on the Russian market. Recessions occurred in 2022 and 2024, which reflects the general economic trends in the country.[3]

The volume of the Russian market for electric lamps for the year decreased by 11% and amounted to 605 million units

Sales of electric lamps of all types in Russia in 2024 decreased by 11% compared to the previous year and amounted to 605 million units against 675 million units in 2023. Over the five-year period from 2020 to 2024, the total market contraction reached 19% from the base level of 747 million units. The data was published in a study by BusinesStat in July 2025.

According to the report, the only increase in sales was in 2021, when the volume increased by 6% to 789m units. The restoration was associated with the resumption of the activities of commercial and industrial organizations after the lockdown, the defrosting of projects to replace outdated lighting equipment and the continuation of the implementation of state improvement programs.

The leading enterprises of the industry are:

- Prom-Svet LLC;

- LLC Cascade"";

- Volzhsky Lighting Engineering Plant Luch LLC;

- NPK Incotex LLC;

- Martini Rus LLC.

The active development of the online trading sector also stimulated the demand for electric lamps for the construction of logistics and warehouse complexes in 2021. This ensured a temporary recovery of the market after the pandemic downturn.

In 2022, sales fell sharply by 13% to 687 million units, which was the beginning of a steady downward trend. In 2023, the fall slowed to 2%, but accelerated to 11% in 2024, which led to a minimum sales volume for the period under review.

The structural changes in the market are due to the growing demand for LED lamps. Consumers rated their energy efficiency and durability compared to traditional light sources.

With an average service life of incandescent lamps of 1 thousand hours, LED lamps can work from 20 to 50 thousand hours. A significant difference in service life affects the frequency of replacement and the total volume of purchases.

The share of previously popular incandescent lamps in total sales decreased from 32% in 2020 to 22% in 2024. The gradual elimination of energy-consuming technologies reflects a change in consumer preferences.[4]

2023: Sales growth of chandeliers and lamps by 2.8% to 143.5 million units

In 2023, approximately 143.5 million chandeliers and lamps were sold on the Russian market. This is 2.8% more compared to the previous year, when sales were estimated at 139.6 million units. Such data are given in the BusinesStat study, the results of which are presented on July 25, 2024.

It is noted that the bulk of the industry under consideration in the Russian Federation is occupied by imported products supplied mainly from China. Domestic manufacturers hold only a small market share, since it is difficult for them to compete with inexpensive products from the PRC. At the same time, the imposition of sanctions in the context of a deteriorating geopolitical situation allowed Russian companies to strengthen their positions by occupying market niches, which were vacated after the departure of foreign brands such as Legrand and Signify. Among the significant domestic players are named "IEC Holding," "TD Morozova," "MGK" Light Technologies, "" Lampiris Plant "and " Ardatov Lighting Plant. "

It is estimated that about 143.6 million chandeliers and lamps were sold in Russia in 2019. In 2020, the volume of sales decreased by 4.9% - to 136.6 million units. The chandelier and luminaire market is heavily dependent on the construction sector. However, against the backdrop of the COVID-19 pandemic, the activities of construction sites in many regions of the Russian Federation were suspended for several months, which provoked a decrease in demand for lighting equipment.

In 2021, an increase of 10.4% was recorded with a final result of 150.8 million products sold. In 2022, sales of chandeliers and lamps decreased by 7.4%, which is due to sanctions restrictions. But already in 2023, according to BusinesStat analysts, the main difficulties were overcome, and the industry returned to growth. Experts believe that the greatest potential for the development of domestic production is concluded in the segments of architectural, industrial and street lighting.[5]

Notes

- ↑ In 2025, sales of commercial and industrial lighting equipment in Russia decreased by 4% and amounted to 35 million units.

- ↑ Lamp production in Russia 2024: market trends, dynamics and prospects

- ↑ For 2020-2024, the import of light equipment to Russia decreased by 8%: from 114 to 105 million units.

- ↑ and 2020-2024 sales of electric lamps of all types in Russia decreased by 19%: from 747 to 605 million units.

- ↑ In 2023, sales of chandeliers and lamps in Russia increased by 3% and amounted to 144 million units.